How a 2D Payment Gateway Enhances Safety and Performance in E-Commerce

How a 2D Payment Gateway Enhances Safety and Performance in E-Commerce

Blog Article

A Comprehensive Overview to the Mechanics and Importance of Making Use Of a Settlement Entrance in Digital Transactions

In today's significantly electronic market, comprehending the auto mechanics and value of settlement portals is paramount for any company engaged in on the internet purchases. As we discover the numerous elements of settlement portals, from their core operates to the critical features that distinguish one from another, it becomes evident that a nuanced comprehension can significantly impact a company's operational efficiency and consumer satisfaction.

What Is a Settlement Portal?

A settlement entrance is a modern technology that assists in the transfer of repayment info in between a client and a vendor's bank. It works as an intermediary, making certain that delicate monetary data is securely transmitted throughout on-line transactions. By securing the consumer's settlement details, the portal protects against scams and unauthorized access, which is important in preserving customer trust fund in electronic commerce.

Repayment entrances support different repayment methods, consisting of bank card, debit cards, and digital purses, making them essential for organizations seeking to deal with diverse consumer preferences. They are typically incorporated into ecommerce platforms, enabling for smooth checkout experiences. In addition, payment portals provide features such as purchase tracking, reporting, and repayment monitoring, which aid organizations in monitoring their economic performance.

The function of settlement gateways prolongs past mere deal handling; they also add to compliance with market criteria, such as the Payment Card Sector Data Safety And Security Criterion (PCI DSS) This compliance is essential for protecting customer info and decreasing obligation threats for vendors. In summary, a settlement entrance is an important element of contemporary shopping, enabling protected and effective deals while improving the total consumer experience.

Just How Payment Portals Job

The capability of repayment gateways pivots on a collection of interconnected procedures that ensure efficient and protected transaction execution. When a customer initiates a purchase, the settlement entrance secures the purchase information to safeguard sensitive information, such as credit history card information. This encryption transforms the data right into a safe style, making it unreadable to unapproved events.

As soon as the information is secured, it is transmitted to the acquiring financial institution or repayment processor, that checks the legitimacy of the transaction. This entails confirming the client's payment info and guaranteeing there suffice funds in the account. The acquiring financial institution then interacts with the releasing bank, which is the financial institution that issued the client's card, to accredit the transaction.

Upon getting the consent, the issuing financial institution sends an action back via the repayment portal, indicating whether the transaction is authorized or declined. The repayment gateway completes the purchase by notifying the vendor and facilitating the transfer of funds from the consumer's account to the vendor's account if authorized. This entire procedure usually happens within secs, supplying a smooth experience for both the consumer and the merchant.

Trick Features of Repayment Portals

While numerous payment portals exist, specific essential functions differentiate them and improve their performance for both customers and vendors. Protection is paramount; top-tier payment portals use innovative security strategies and conformity with Repayment Card Market Data Security Standards (PCI DSS) to safeguard delicate purchase information. This secures both the vendor's and customer's monetary info from fraud and violations.

An additional essential attribute is the capability to support multiple settlement techniques. A flexible payment portal must assist in various purchase types, consisting of credit report and debit cards, e-wallets, and bank transfers, accommodating varied client preferences. Furthermore, seamless combination with existing e-commerce platforms and shopping carts is important, allowing sellers to include payment handling without considerable technical obstacles.

User experience is additionally necessary; effective settlement entrances provide a smooth and instinctive user interface, decreasing cart desertion rates. Real-time handling abilities ensure fast transaction confirmations, enhancing client complete satisfaction. Additionally, detailed reporting and analytics devices allow merchants to track sales, screen efficiency, and make notified company choices. These essential attributes collectively empower organizations to operate efficiently in an affordable electronic marketplace while offering a practical and safe and secure experience for consumers.

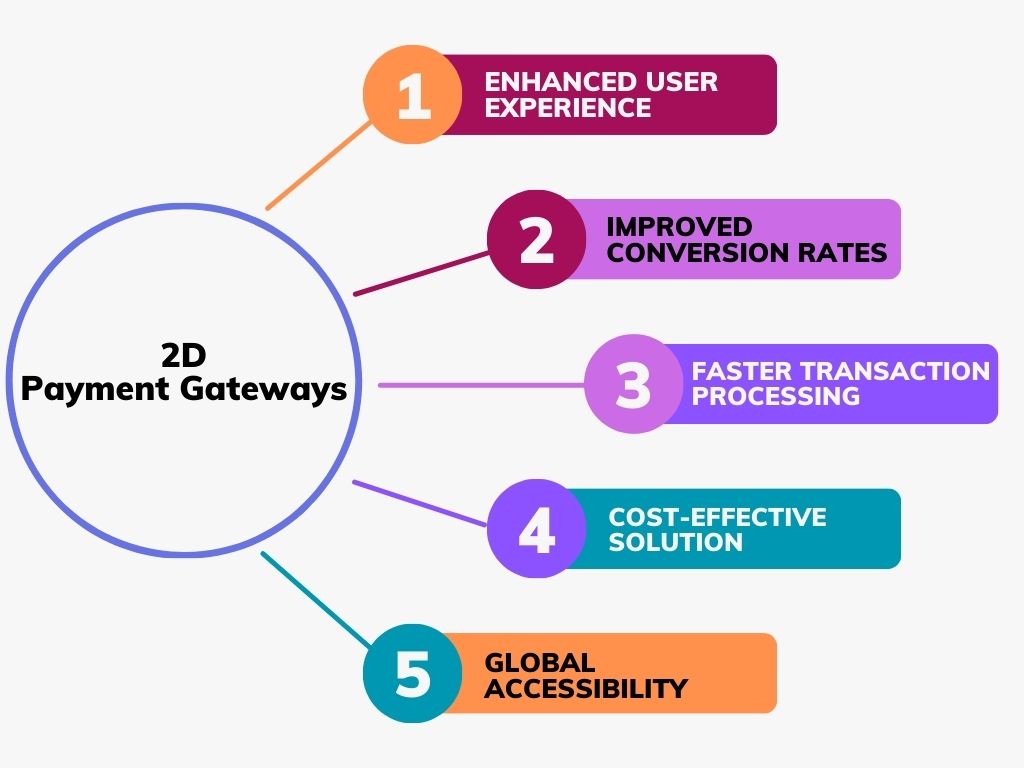

Advantages of Making Use Of Settlement Portals

Making use of payment gateways offers numerous advantages for businesses seeking to enhance their online transaction processes. One of the primary advantages is safety; repayment entrances utilize sophisticated file encryption modern technologies to protect delicate customer info, lowering the threat of fraud and information violations. This boosted safety and security not just safeguards customer data but also promotes trust, encouraging repeat service.

Additionally, settlement gateways enhance the purchase procedure, permitting for quicker and more effective repayments. This performance can bring about enhanced cash money flow, as transactions are processed in real-time, assisting in quicker access to funds. In addition, they sustain multiple repayment approaches, consisting of bank card, debit cards, and digital pocketbooks, catering to a wider consumer base.

Many repayment portals use analytics and reporting devices, providing useful understandings right into customer behavior and transaction trends, which can educate advertising approaches and enhance general business efficiency. In recap, settlement portals are important for my website services aiming to optimize their digital purchase landscape.

Choosing the Right Payment Portal

Choosing the best repayment gateway is important for companies view aiming to maximize their on-line purchase procedures. The selection of a repayment gateway effects not only the customer experience however also the total effectiveness and protection of deals.

When examining prospective entrances, services must think about several essential variables. Assess the fees associated with each gateway, including transaction fees, regular monthly costs, and any type of concealed expenses, as these can significantly impact earnings margins. Next, examine the portal's combination abilities with existing shopping systems or software, making sure a seamless connection that reduces disturbances.

Security is one more critical element; search for gateways that adhere to PCI DSS requirements and use advanced scams detection devices. Additionally, consider the variety try this out of repayment alternatives supported, as a diverse choice can enhance consumer complete satisfaction and conversion rates.

Verdict

In final thought, repayment gateways offer a crucial function in the realm of electronic deals by making certain safe and secure, reliable processing of repayments. The tactical selection of a settlement portal tailored to particular business needs can significantly improve financial management and operational efficiency.

Additionally, settlement portals use functions such as deal monitoring, reporting, and settlement administration, which help services in monitoring their monetary efficiency.

The role of repayment entrances prolongs past plain deal handling; they likewise add to conformity with market criteria, such as the Repayment Card Market Information Safety And Security Criterion (PCI DSS) Safety is paramount; top-tier settlement gateways employ innovative file encryption techniques and compliance with Settlement Card Industry Data Safety Standards (PCI DSS) to protect delicate purchase data.Furthermore, repayment portals streamline the transaction process, enabling for quicker and extra efficient payments.In final thought, repayment portals offer a vital function in the realm of digital deals by making certain safe and secure, efficient handling of repayments.

Report this page